How To Determine After Repair Value

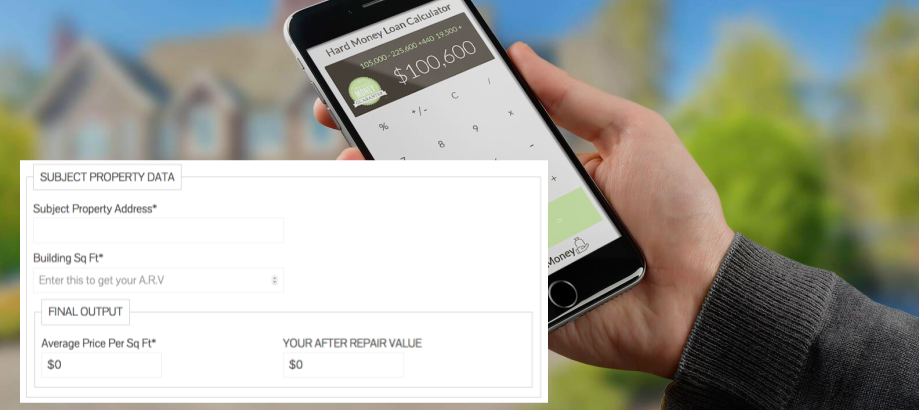

Welcome to your free online ARV calculator.

If you don't have comps, you can…

The computer will not take comps more than 6 months old or more than 1 mile radius from your field of study holding.

ENTER YOUR COMPS DATA Below…

What is the ARV Calculator?

ARV calculator is used to summate the ARV of a slice of real estate property.

ARV stands for Afterward Repair Value of existent manor properties.

It's essentially the off-white market value of the property after it has been repaired or improved by an investor, the buyer.

There are other calculators that can likewise be used to decide how much coin yous should put down on your loan when purchasing a home.

How Does it Piece of work?

An ARV calculator tin can help y'all make an informed decision about ownership your adjacent real manor rehab project whether it'south your start time or not.

Let'southward talk more than about the later on repair value; here are some of the highlights…

- How ARV is Used Existent Manor InvestingHow ARV is Used Real Estate WholesalingWith Estimated Repair Costs, The ARV Creates A Maximum Commanded OfferJust Like Repair Value Added, Later on Repair Value is SubjectiveTraditionally, A Relationship With A Real Estate Agent Was The Only Way To Get Comps & Calculate After Repair ValueHow To Use The Computer For Your Real Estate InvestmentsWhat Are The Benefits Of Using An ARV Calculator?

Let's dive right in…

How ARV is Used Real Estate Investing

Real estate investing tin be a bully manner to make money and build wealth.

Nevertheless, information technology'southward important to empathize the nuts earlier getting started.It's important to talk over the after repair value (ARV) of an investment property, and how to calculate information technology.The after repair value is the estimated market value of a property after information technology has been repaired or renovated. It's important to know the after repair value of an investment belongings before investing in it, as this will help you make up one's mind whether or non the investment is worth your time and money.To calculate the afterwards repair value (ARV) of an investment property, you'll need access to comparable sales in the area within the last 1 yr and 1 mile radius of the investment property.

What Is A Comparable in Real Manor?

In real manor, a comparable is a like property that has been sold recently, in order to help estimate the value of a holding.

And in this case of real estate investing, nosotros call it the after repair value indicating the fact that information technology is probable that candidate investment property will need piece of work.Comparable properties are used to give an idea of what the investment property may exist worth, later taking into account whatsoever contempo renovations or upgrades. Again, the comparable properties for a typical market has to exist within from a maximum of 1 year sales record and no further than 1 mile away from the subject property.For the rest of this commodity, we will use refer to every bit comparable properties as existent manor comps; comps for brusque. Comps can also be used to determine whether an investment property is beingness priced adequately or non. Property value is generally a professionally weight average of the real estate pricing within close proximity from the subject area property.

How ARV is Used Existent Estate Wholesaling

Real estate wholesaling is the process of finding a bargain property and selling it or assigning the right to purchase information technology to another investor, often before the property has been renovated.

The goal is to find a quality holding at a discount price with respect to the holding value and quickly resell information technology for a profit. This business model can be extremely profitable, but it can also be quite risky.The outset pace in real estate wholesaling is finding a deal belongings. This can exist done by looking for pre-foreclosures, and motivated sellers.That showtime step of existent estate wholesaling every bit outlined in a higher place tin can exist farther broken down into further steps as follows:

- Data Admission and Contact Initiation

Once you have establish a belongings that meets your criteria, y'all will demand to do your due diligence to make certain that it is a good investment.In the world of real estate, the after repair value, or ARV, of a property is extremely important as explained before when it comes to real estate investing.

The Primary Purpose of Wholesaling is to Detect Properties for Existent Estate Investors.

So the ARV is the estimated property value after any necessary repairs accept been made.

It'southward what determines whether or not a property is a good investment for the potential end buyers/real estate investors and how much profit a wholesaler can hope to brand.Per the investor level, the real estate comps and ARV is reviewed with a number of factors, including the age and condition of the holding, the current marketplace conditions, and the cost of repairs. Merely a wholesaler would only demand to be able to judge repair costs with a reliable organisation at a more surface level.Typically, evaluating a property repair costs can be washed with low/medium/loftier level calibration is enough to rapidly appraise the viability of a holding for investment.So information technology'due south important to have a realistic judge of the ARV in guild to make sound investment decisions.Investors use the ARV to make up one's mind whether or non a property is worth buying. So wholesalers utilise aforementioned method to evaluate properties alee of investors' more in-depth evaluation

With Estimated Repair Costs, The ARV Creates A Maximum Commanded Offering

When it comes to real estate investing, one of the almost important concepts that you need to understand is the concept of the "maximum allowable offering" (MAO).

This is the maximum amount that you're willing to pay for a property, regardless of what the current marketplace value happens to be. There are a few reasons why you would want to know your MAO.First, if you're ever in a state of affairs where yous're competing with other investors for a property, you'll want to make sure that you lot don't go over your MAO. This volition aid ensure that you lot don't finish up overpaying for a property. Second, by knowing the MAO, y'all'll exist able to make more informed decisions about which backdrop y'all want to pursue. For example, if y'all're behest on a property that is listed at market value, but your MAO is considerably lower than the request price, you won't want to pursue information technology. By avoiding properties that are listed above market place value, you'll be able to avoid wasting fourth dimension and money on bids for backdrop.This computer is a corking tool to help you determine the maximum allowable offer for a property from real manor comps. It also takes into account the estimated repair costs, so you tin can be sure that you're non overpaying for a domicile considering they are typically in conditions that needs repair.

Simply Like Repair Value Added, Later on Repair Value is Subjective

Value-added is a term used in business to draw the amount of increment in the worth of a product or service.

It is usually calculated past subtracting the cost of materials and labor from the selling price. The departure is the amount of value added by the company.

Why is it Necessary To Summate Repair Value Added?

When it comes to real manor, the term "repair value added" is used to describe the amount of increase in the worth of a property that is a result of repairs and renovations made by the current owner.

This figure is normally calculated by subtracting the cost of materials and labor from the estimated market value of the property. The departure is the amount of value added past the current owner. Repair value added tin can be a valuable tool for assessing how much a belongings has increased in value equally a result of repairs, and can be helpful in negotiating sale prices.

Whether or not a detail repair or renovation adds value to a property is often a matter of personal stance; professional opinion notwithstanding.

Some people may see a new roof equally an essential improvement that increases the value of a holding, while others may see repair costs as a superfluous expense that doesn't add much value.

The same can be said for renovations like remodeling kitchens or bathrooms, adding new floor, or painting the walls. Some people will run into these as valuable improvements that add to the overall appeal of the property, while others may not think they are worth the expense.It is of import to recollect that later repair value is subjective, and it is always wise to get multiple opinions before making any renovations or repairs.

Traditionally, A Relationship With A Real Manor Agent Was The Just Way To Become Comps & Calculate ARVs

Getting an accurate estimation of a property's worth (or "ARV") is essential for making smart investment decisions.

In the past, the only way to get this information was by working with a real estate agent. However, cheers to engineering, at that place are now a number of ways to calculate ARVs on your own. In this article, nosotros'll explore three of the about popular methods.

#1. The outset method is using a holding valuation tool like Zillow or Redfin.

These tools utilise public data to give y'all a rough judge of a belongings'due south value.

While they're not 100% accurate, they can be a good starting point for determining your ARV.

#2. The second method is performing your own CMA (or Comparative Market Analysis).

This method is ideal if you lot're looking to purchase a property in the near future, as information technology provides you lot with an accurate idea of what properties are selling for.

To practice this, yous need to pull comps from the MLS (requiring the help of a existent estate agent) and other sources.

#iii. The concluding method is to hire a professional real estate appraiser, who will commonly charge anywhere from $500-ii,000.

While this method may seem like the most expensive out of all three options, it's also the only one guaranteed to provide you with 100% accurate data.

Even if you go with option #ane or option #2, it can never hurt to order an appraisal once you take a adept idea of the ARV.As an alternative, existent estate amanuensis tin as well transport yous private real manor comps.

How To Pull Comps That Y'all Will Apply With The Calculator For Your Real Estate Investments

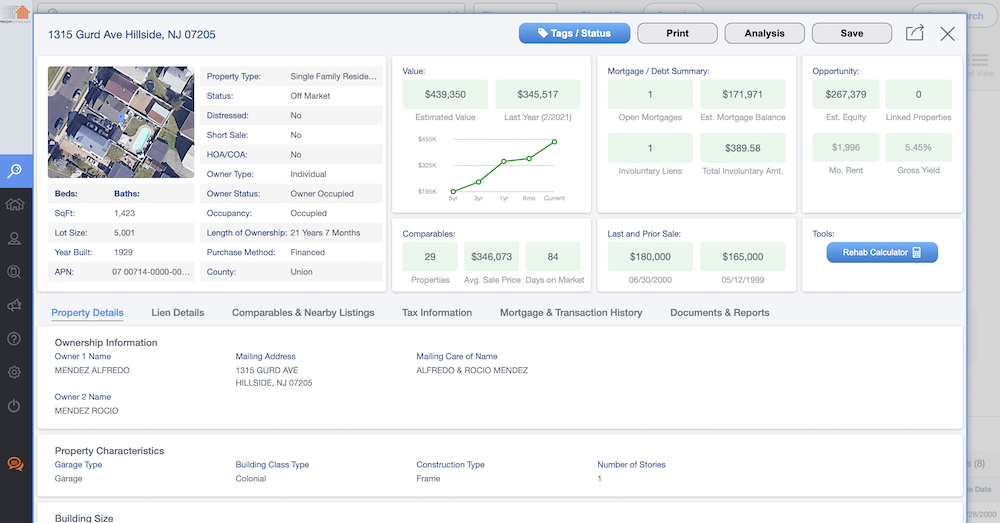

STEP 1 – Login to Propstream. If you don't have an account, sign up for a free trial at www.EmpireBIGData.com

Footstep two – Once you are logged in, you will run into the main dashboard.

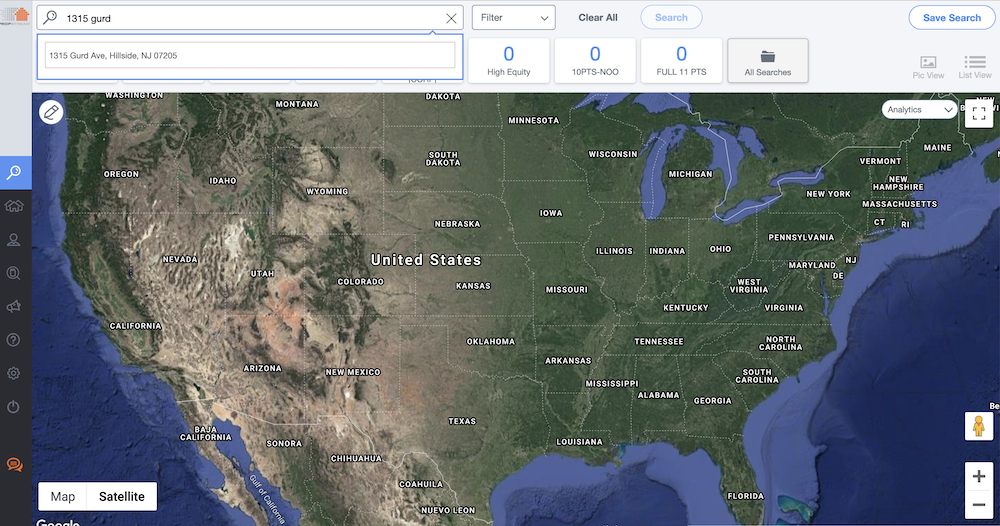

Stride 3 – Enter the subject area property address into the address bar at the top of the dashboard.

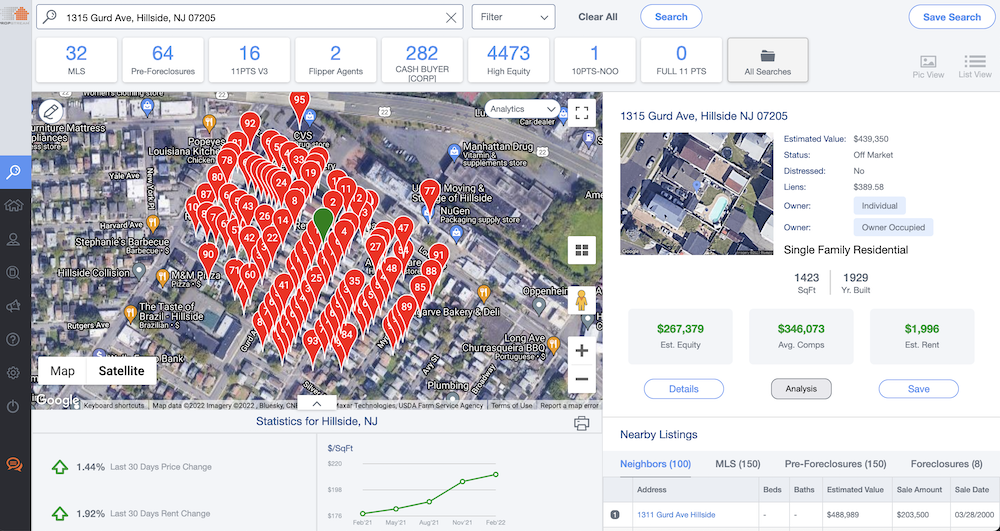

Step 4 – As you click on the machine-suggested accost showing every bit you blazon the property accost, the belongings data folio will pop upwardly.

Pace 5 – Click on the Item push button to evidence the different tabs available to reveal more data virtually the property.

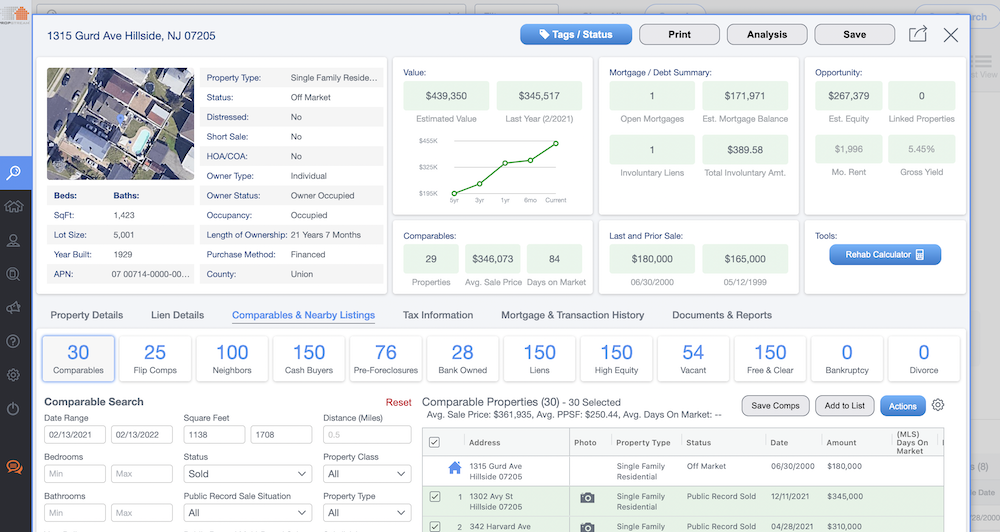

Stride 6 – Click on the tab COMPARABLES & NEARBY LISTINGS to reveal all the backdrop that sold in recent times.

Stride vii – Scroll down below the fold to reveal the listing of all the comps available in a tabular array.

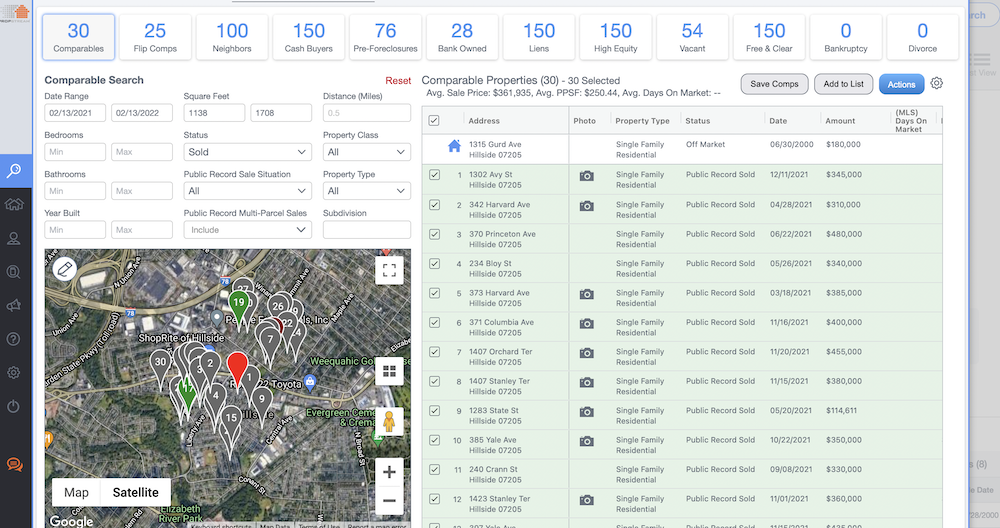

Stride viii – Use the filter form on the left to narrow the comps search downward to only backdrop inside 1 mile radius and sold in the terminal 6 months.

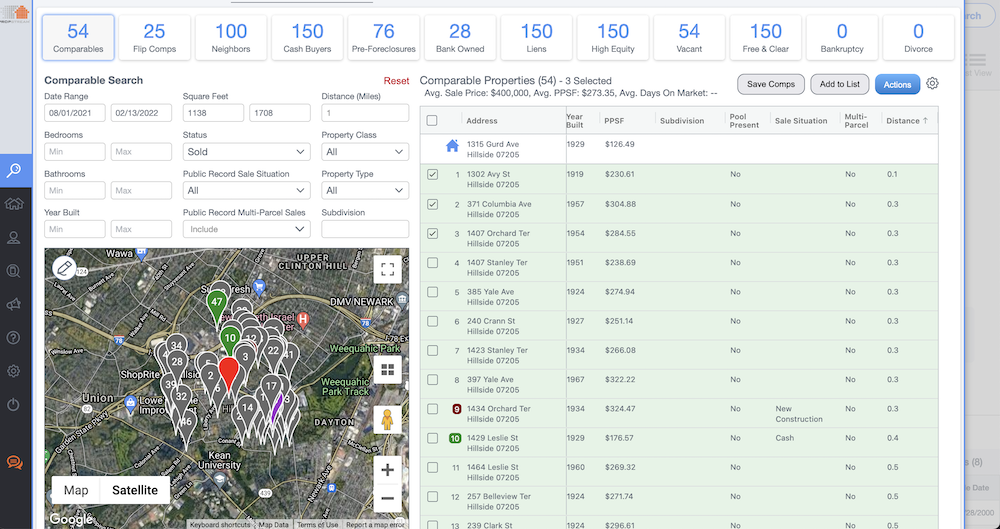

Stride nine – Click the ACTION button and click the VIEW COMP REPORT option to down a full PDF comp study into your device.

Pace 10 – Gyre correct all the way to the Distance column and click the column header to sort to the closest comp to the subject area property.

These are comps that you can use with the calculator at the top of this page.

You tin select every bit few and as more as you want to show up in your study.

Folio i of a Sample Comp Study

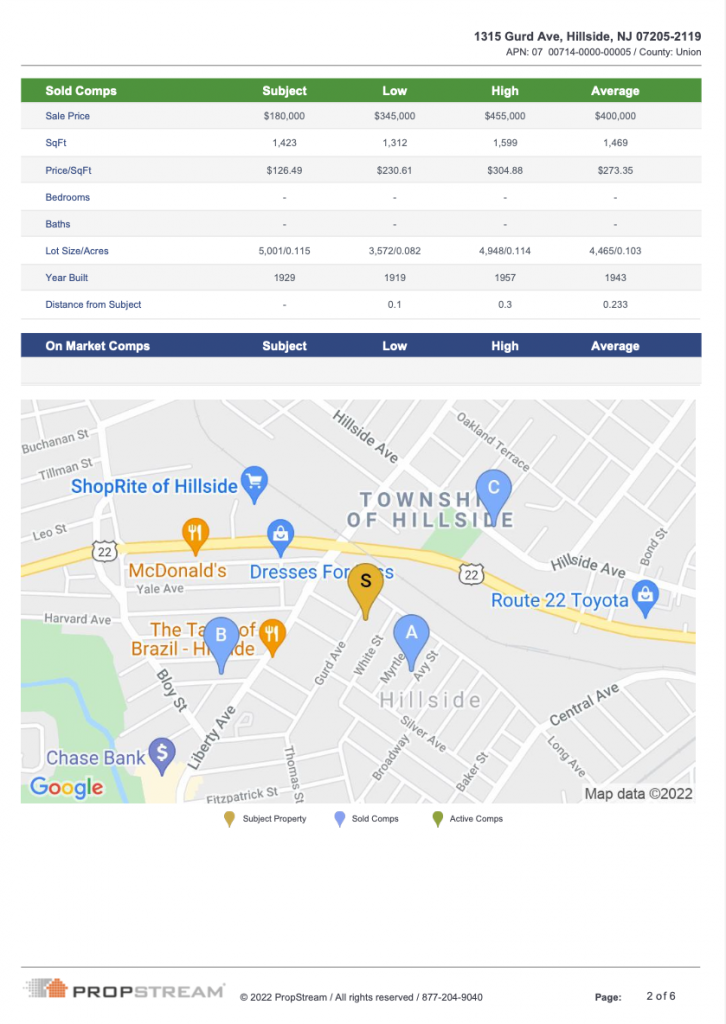

Page two of a Sample Comp Report

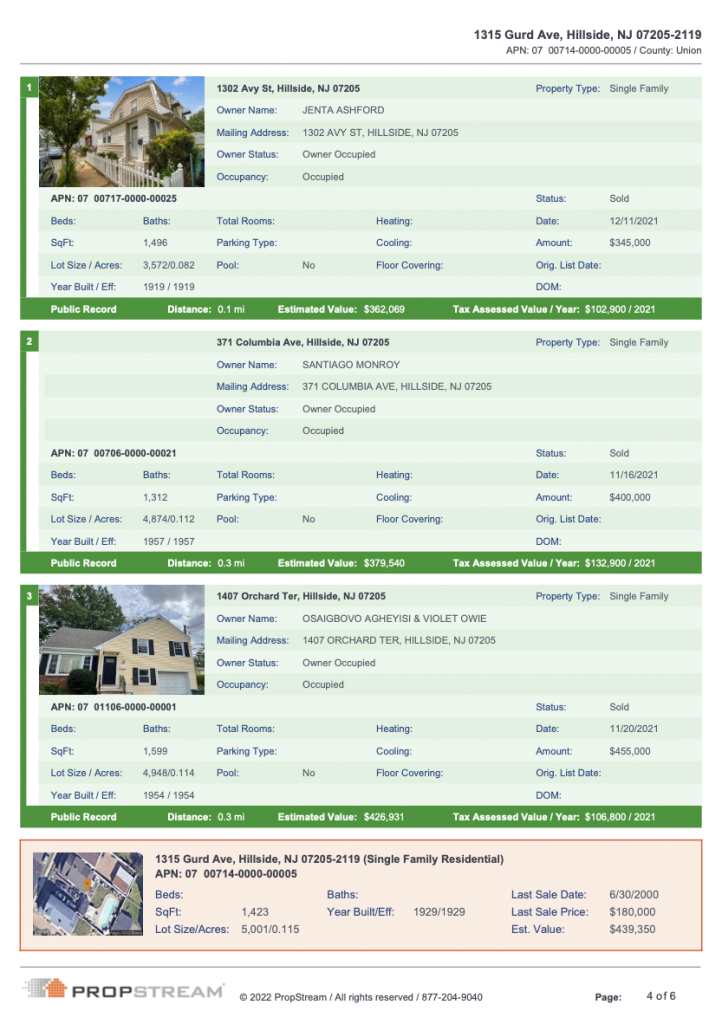

Page iii of a Sample Comp Written report

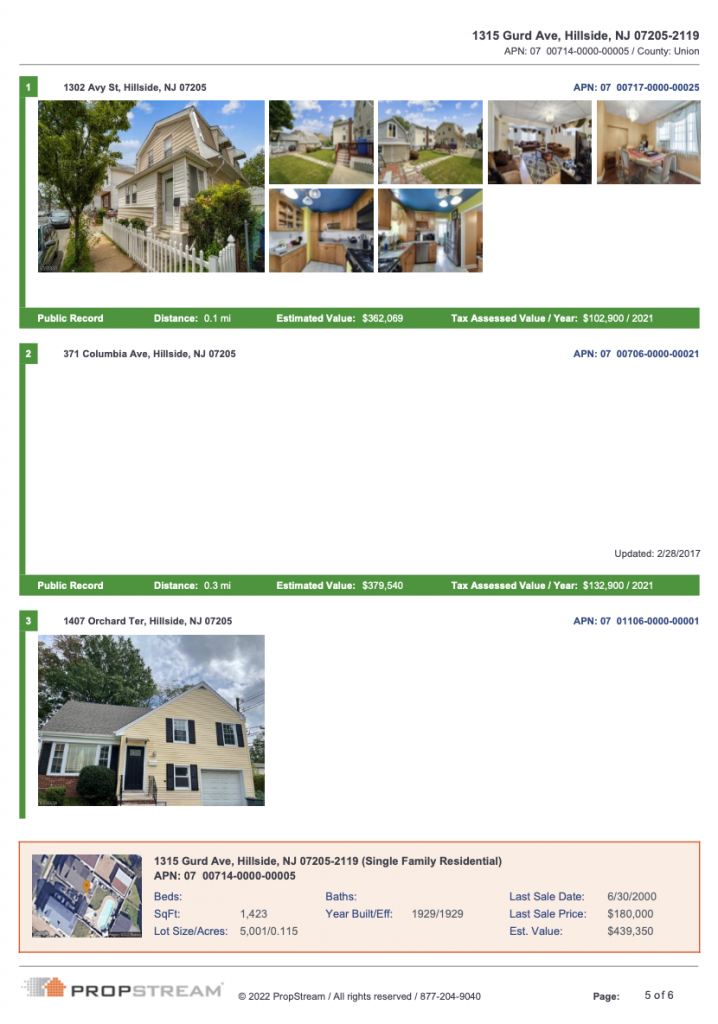

Page 4 of a Sample Comp Report

Page v of a Sample Comp Report

Can you Survive Real Estate Investing & Wholesaling Without This FREE & Online ARV Calculator?

When I get-go started my real manor business organisation, I wasn't exposed to the idea of using ARV to set a profit goal.

I virtually started the application for a loan to acquire a Belleville NJ belongings but thank goodness.

Why?

Because getting into a concern venture without setting goals that tin can be tracked and measured is a terrible thought.

That's what the ARV formula represents in real estate investing.

Literally… information technology removes the blindfold and allows you to approach the real estate business organisation with the noesis of predictive success.

With the ARV, you can come up with a maximum commanded offer get-go and so everything else follows afterward with profits.

Thank you to a few earlier mentors… I was able to larn the ARV formula quickly and before long plenty.

These video series break down my mindset on ARV…

Back then, I created my personal ARV calculator spreadsheet on excel.

There was no Biggerpockets or myEmpirePRO to make these tools available on the go.

Merely these days, all yous need is to bookmark this page into a smart device web browser and finer accept admission to a ARV calculator app on the go.

And then the maximum allowable offer (MAO) that you calculate from the ARV is notwithstanding an estimate driven past educated opinion but so is a certified appraisal from a licensed appraisement.

The certification simply represents insurance and government regulation for consumers simply non necessary value for investors.

A real estate investor or a wholesale professional is a producer and is responsible for the evaluation and valuation of any property of interest.

In Conclusion, What Are The Benefits Of Using An ARV Reckoner?

When you are buying or selling a home, it is of import to understand what the property is worth.

This is where a calculator comes in handy.

A estimator will assistance you gauge the value of a property afterward repairs have been made.

This can be helpful when yous are trying to figure out how much you lot should offering for a habitation or how much you can sell a home for.

A calculator takes into account a number of different factors, including the age and condition of the holding, the location, and the current market conditions.

Information technology volition besides take into account any repairs that demand to be fabricated.

This tin can be helpful when yous are trying to decide if a holding is worth your time and money.

How do y'all calculate an ARV?

ARV stands for Afterward Repair Value and it is calculated by averaging comparable skillful and fair marketplace condition property auction prices within close proximity of your subject area belongings without adjusting for the condition of your subject property.

What is the 70% rule in real estate?

After calculating the afterward repair value (ARV) of a holding, some real estate investors adjust for target profit by multiplying the number past seventy%.

That's the 70% rule but other real estate adopt the 65% while some highly competitive market place do use as high equally 84% rule.

Which ARV calculator is best?

Biased may be… but when nosotros designed this ARV calculator, it was designed to keep it super elementary and also to give you admission to the well-nigh important resources to observe even more than deals. Finding more deals comes down to your marketing skill set in a digital age.

Are ARV calculator accurate?

All ARV calculators are as accurate equally your noesis and familiarity with the real manor market.

There are nuances that only feel tin and will bring only learning how to use an ARV calculator to summate the after repair value is withal the closest empirical way to measure investor success.

How do yous calculate lxx rule in real estate?

You tin can calculate lxx rule in real estate by multiplying the boilerplate recent sales of comparable properties within close proximity by lxx%.

It's a method used past real estate investors to structure in their profit goals in the deal.

What does lxx of ARV mean?

70 of ARV stands for lxx% of the later on repair value (ARV) of a real estate holding to make up one's mind the maximum cost of acquisition.

I hope you relish this content. Don't forget to catch the 2 FREE books, Smart Real Estate Wholesaling & Real Estate Money Secrets... PLUS 3 Hours Masterclass Workshop, 100% Costless... by Clicking Hither...

Playlist To Our Newest Videos

How To Determine After Repair Value,

Source: https://myempirepro.com/calculators/arv-calculator/

Posted by: hernandezwasm1991.blogspot.com

0 Response to "How To Determine After Repair Value"

Post a Comment